Net cost plus margin

4 The Net Cost Plus Margin is the ratio of Net Operating Profit to Total Operating Expenses. WY Kale - 2005 -.

How Do Gross Profit Margin And Operating Profit Margin Differ

The sum of which gives us our gross profit.

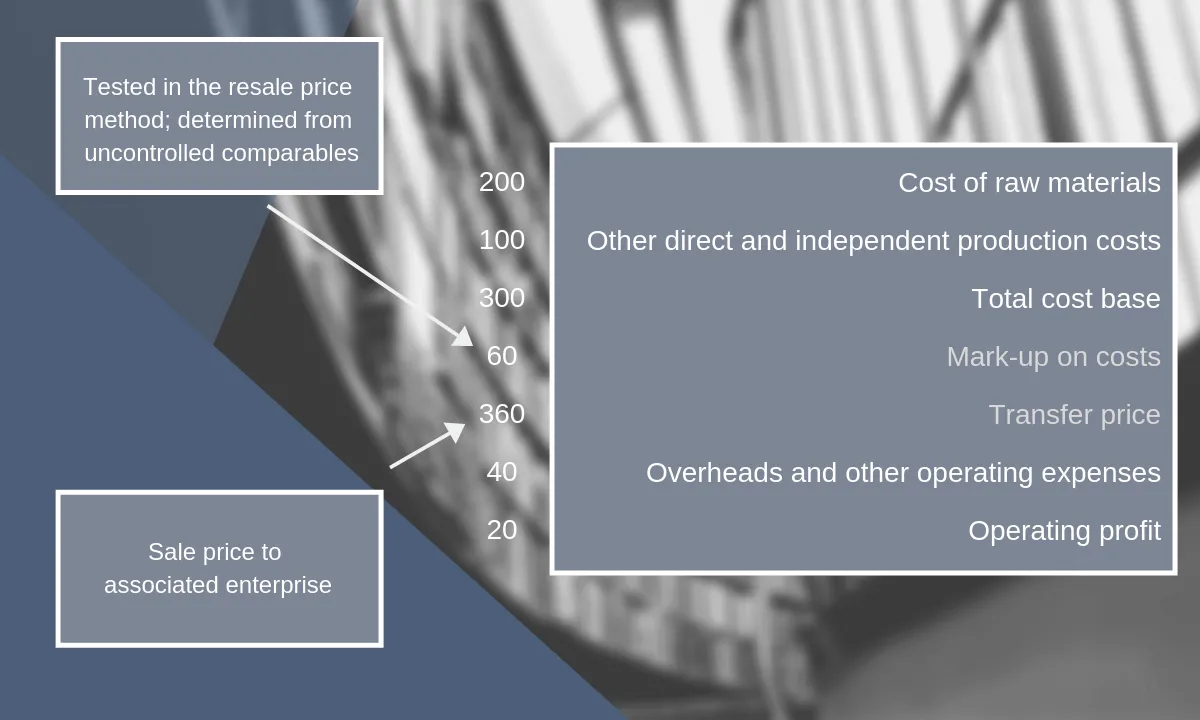

. Its one of the oldest pricing strategies in the book. Or the cost-plus method if the comparison of the gross profit margin or the direct and indirect cost mark-up of the controlled transaction and the relevant financial indicators of unrelated. Later in the text the Net Cost Plus Margin.

You had total expenses of 300000. This is the most basic and simplest. Cost-plus pricing is a pricing strategy that adds a markup to a products original unit cost to determine the final selling price.

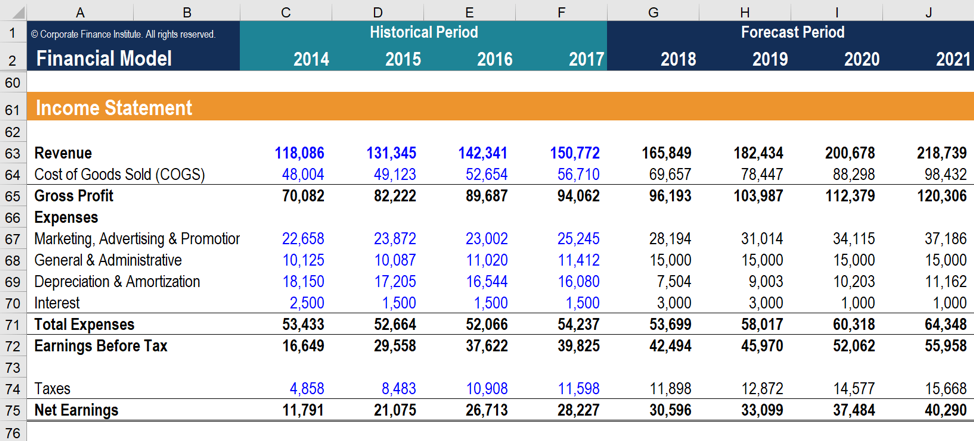

Profit margin is the amount by which revenue from sales exceeds costs in a business usually expressed as a percentage. Net Cost Plus Margin Operating profit Total operating costs. We then multiply the result by 100.

Cost price 1 - Gross margin ratio x Selling price Cost price 1 - 60 x 16250 Cost price 40 x 16250 Cost price 6500 On this product the cost price negotiated. Under the Cost Plus Method X should then first compare its cost base with the cost base of B when manufacturing 100000 Iphone cases for a third party client. This means that for every 1 of revenue the business made 035 in net profit.

PDFAdobe Acrobat - Quick view. Net Operating Profit is. Total costs Cost of Goods Sold Operating Expenses Gross Margin Gross Profit Net.

Cost-plus pricing is a pricing strategy in which the company adds up the profit margin markup to the cost of making the product. Net profit margin 440000 - 300000 400000 035 35. The formula for calculating it is as follows.

Net Cost Plus Margin. Our next task is to divide the sales gross profit 4400 by the items selling price 9900. Operating margin Operating Income net sales Net Cost Plus Operating Income Total Costs.

Gross profit margin 13. Cost-plus pricing is a pricing method companies use to arrive at a sale price for their product or service. It can also be calculated as net income divided by revenue or net.

Cost-plus pricing takes into account the direct material labor and.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Transfer Pricing Methods Crowe Peak

The Transactional Net Margin Method Explained With Example

Net Profit Margin Definition How To Calculate It Tide Business

The Transactional Net Margin Method Explained With Example

Transfer Pricing Methods Crowe Peak

How Profitability Metrics Measure Earnings Performance Margins

The Five Transfer Pricing Methods Explained With Examples

The Transactional Net Margin Method Explained With Example

The Five Transfer Pricing Methods Explained With Examples

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

The Five Transfer Pricing Methods Explained With Examples

How Profitability Metrics Measure Earnings Performance Margins

Net Profit Margin Definition How To Calculate It Tide Business

Transfer Pricing Methods Royaltyrange

The Five Transfer Pricing Methods Explained With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ